Innovative capital markets platform for transactions, investor communications and corporate reporting

Reduce the risk and control how you produce investor communications, annual reports or IPO Prospectus with the first fully integrated platform, that centralizes data, enables collaboration, and integrates verification, compliance and data connectivity

Trusted By

Simplify complex processes

Modular Features & Workflow

- Template Matters, First Drafts and Precedents

- Dynamically Sync Documents and Data

- Collaborate, Draft, Review and Approve

- Automate Verification & Due Diligence

- Automate Disclosure Requirements

- Produce Typeset outputs in PDF-A, Word, HTML or XML

Diverse Use Cases & Documents

- Equity and Debt Capital Markets

- Corporate Reporting and Ongoing Compliance

- Listing Oversight and Management

- ILS, Insurance and Reinsurance

- Banking and Finance

- Policy and Compliance Management

“ScribeStar allows document drafting, verification, analysis and updating to happen in one central collaborative location. The verification, checklist and task tools save so much time and energy, and as a legal and compliance professional, I wish I had been introduced to ScribeStar sooner.”

“Using ScribeStar on this transaction was a huge time saver… Previously we would do all work on our own copies of the same document, and

someone would have to consolidate the changes at the very end. With ScribeStar, we were able to do all our edits at the same time,

which saved us from some very late nights.”

“All parties collaborating on a client’s prospectus documentation can cut swathes through the time it takes to draft and annotate with the process automation power of ScribeStar”

ScribeStar automates manual, time-consuming tasks behind legal processes, compliance and corporate reporting .

Our secure, end-to-end platform supports legal, finance, and corporate teams to streamline document production, assembly, and automation by unifying financial and non-financial data. It reduces compliance risk, improves control and increases productivity for teams

↓ Risk ↑ Control ↑ Efficiency

ScribeStar’s Toolbox

Automate First Drafts

Start from templates, precedents or upload from Word. Initiate first draft from templates populated from csv/xls

Role Based Access

Owner, editor, checklister, verifier. Assign roles on the level of doc parts. Hide parts or make read-only. Suspend access.

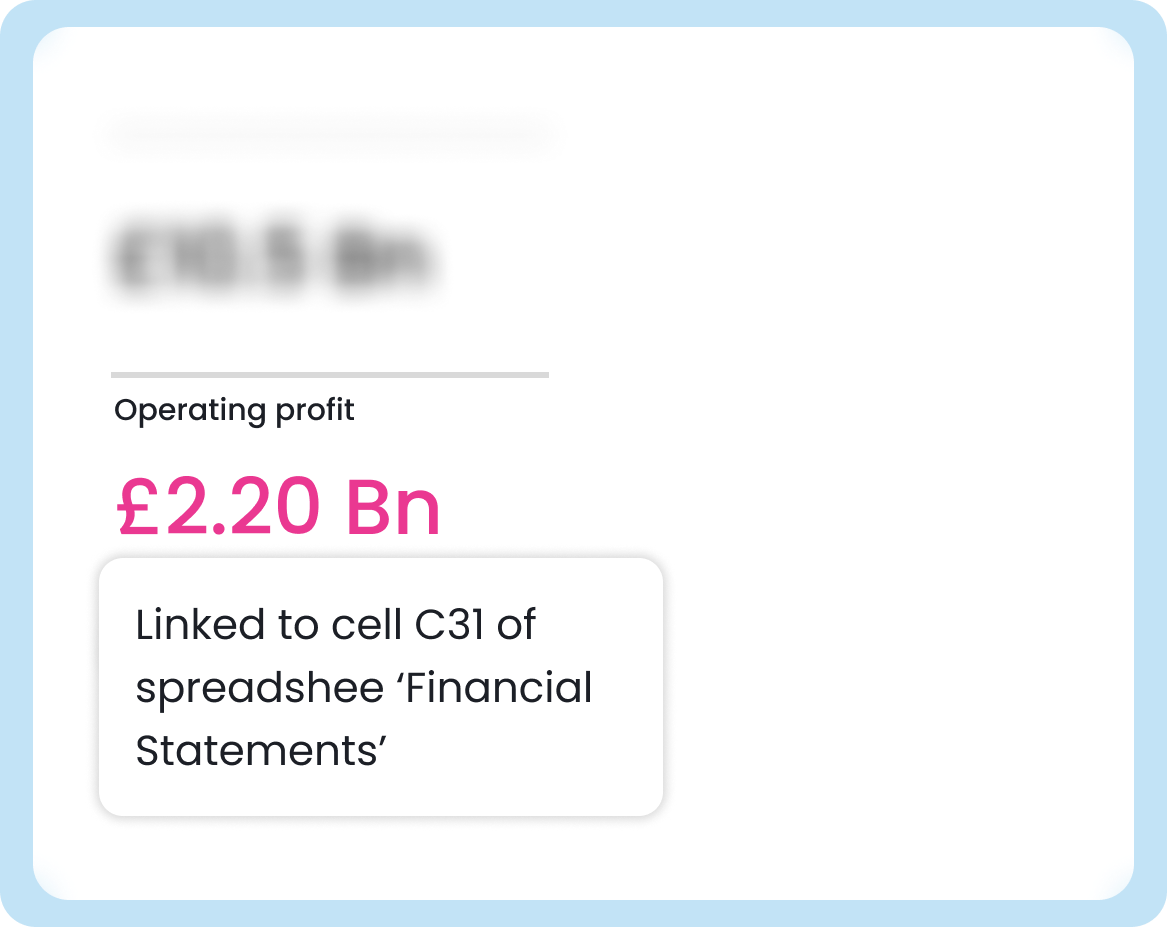

Connect Data & Documents

Update documents via data blobs and spreadsheets. Connect documents with shared text and parts.

Comments And Reviews

See suggested changes to reject and review. Make, resolve, reply to, and toggle private and public comments.

Definitions & Blob Management

Automatically tag and edit definitions, terms and other data points in the document. Hover over them to see meaning.

Automated Cross Referencing

Automated cross-references for numbered items, heading text and page numbers

Drafting & Approval Workflows

ScribeStar editor allows 30+ users to edit and work on the document in parallel, on documents of any size

Version Control And Blacklines

ScribeStar automatically versions the documents. Access and manage history. Automatically produce blacklines and page-pulls

Typesetting And Publishing

Documents are automatically typeset and formatted in real time, removing the cost and risk of involving financial printers

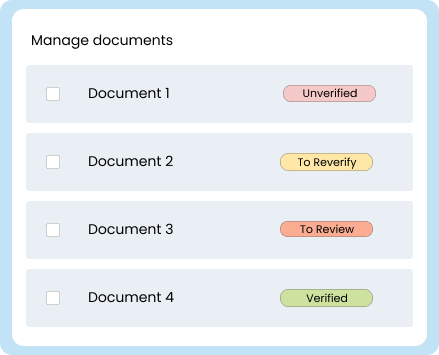

Digital Verification

ScribeStar digitalises and streamlines the verification (factual-backup) process. No more spreadsheets and other inadequate tools.

Flexible Approach

Use ScribeStar for verification only – or combine verification with concurrent drafting/editing. The system will notify you when a statement due to a change needs to be reverified.

Built-in Data Room

Utilise ScribeStar’s built-in storage to upload and connect verification evidence and files. Generate investor-ready verification notes with links to evidence.

Approval Workflows

Assign verification tasks and tailor access for different users and user-groups. Easily search and filter verification statements

Powerful Mark-up

Automatically mark-up the document for verification. Ability to mark-up figures, text and images.

Verification Notes

Search and filter verification statements, responsibilities, and process statuses to produce custom verification reports on the go

Verification Bundles

One-click production of verification notes, marked-up documents, spreadsheets with lusts and links to evidence, as well as a full audit trail of every action taken in the process

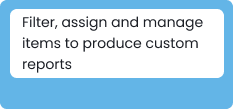

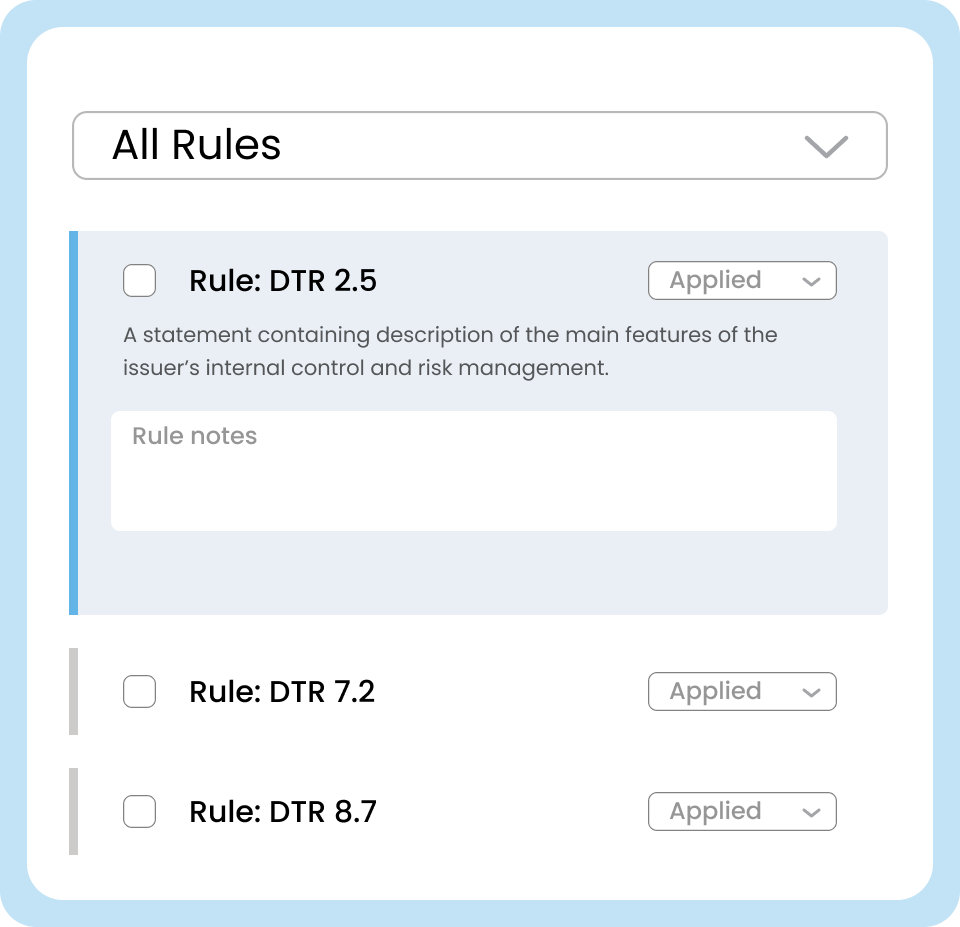

Digital Checklisting

ScribeStar digitalises and streamlines the checklisting process. No more spreadsheets and manual margin annotations.

Tick Box Exercise

Connecting the document and checklist items is a simple exercise of clicking on the applicable item or rule and the corresponding text in the document to digitally connect the two.

Regulatory And Listing Checklists

We track all the major regulators and markets for latest/current checklists (cross-reference lists). Access UK/FCA and 10+ other global markets/regulators for always current checklists.

Corporate Reporting Checklists

We transform regulations, policies, practice guidelines, policies and other sources into actionable digital checklists – such as Companies Act, Corporate Governance Code, Sustainability standards, and others.

Custom Checklists And Condition Precedents

We digitalise, onboard and make available your internal checklists, policies, to-do lists or condition precedent lists for your internal and external teams.

Checklist And Draft Concurrently

Checklist the document while it’s being created. System flags items and rules that need to be rechecked if the text has been updated.

Pre-checklisted Templates And Precedents

Keep and maintain your already checklisted documents on ScribeStar and use them as your starting point for the next draft or reporting cycle. ScribeStar will automatically flag what rules and checklists need to be updated.

Checklist Bundles

Automatically produce a checklist bundle – checklist tables in Word with page numbers and notes indicated for each rule, the document in Word and PDF with margin annotated rules, as well as blacklines comparing to previously checklisted versions.

Efficiency

ScribeStar automation ensures efficiencies, increased productivity and cost savings across the document production and compliance process.

Security

ScribeStar is ISO:27001 Certified and Cyber Essentials Plus Certified. Data is encrypted in transit and at rest. Secure Key Vault. Data isolation and sovereignty. 24/7 Intrusion detection and monitoring.

Audit Trail

A complete audit trail available at all times for all historical versions and actions on the document, including closing budnles and evidence used for verification and other compliance checks.

Structured Data

In addition to traditional formats (Word, PDF-A, HTML), ScribeStar produces documents in XML, JSON and DITA machine-readable formats, allowing you to harness the power of the information you produce.

How Haleon transformed their reporting process

Discover how Haleon simplified complex reporting with Scribestar—real-time collaboration, built-in verification, and seamless multi-format outputs.